How To Save Money Budgetting Based On Last Months Income

7 Min Read | April twenty, 2022

So, peradventure you lot've got an irregular income—significant you don't make the same amount of money every paycheck. If that'due south you, you aren't alone. Enough of people work hourly or commission-based jobs or have side gigs that change up their income every month.

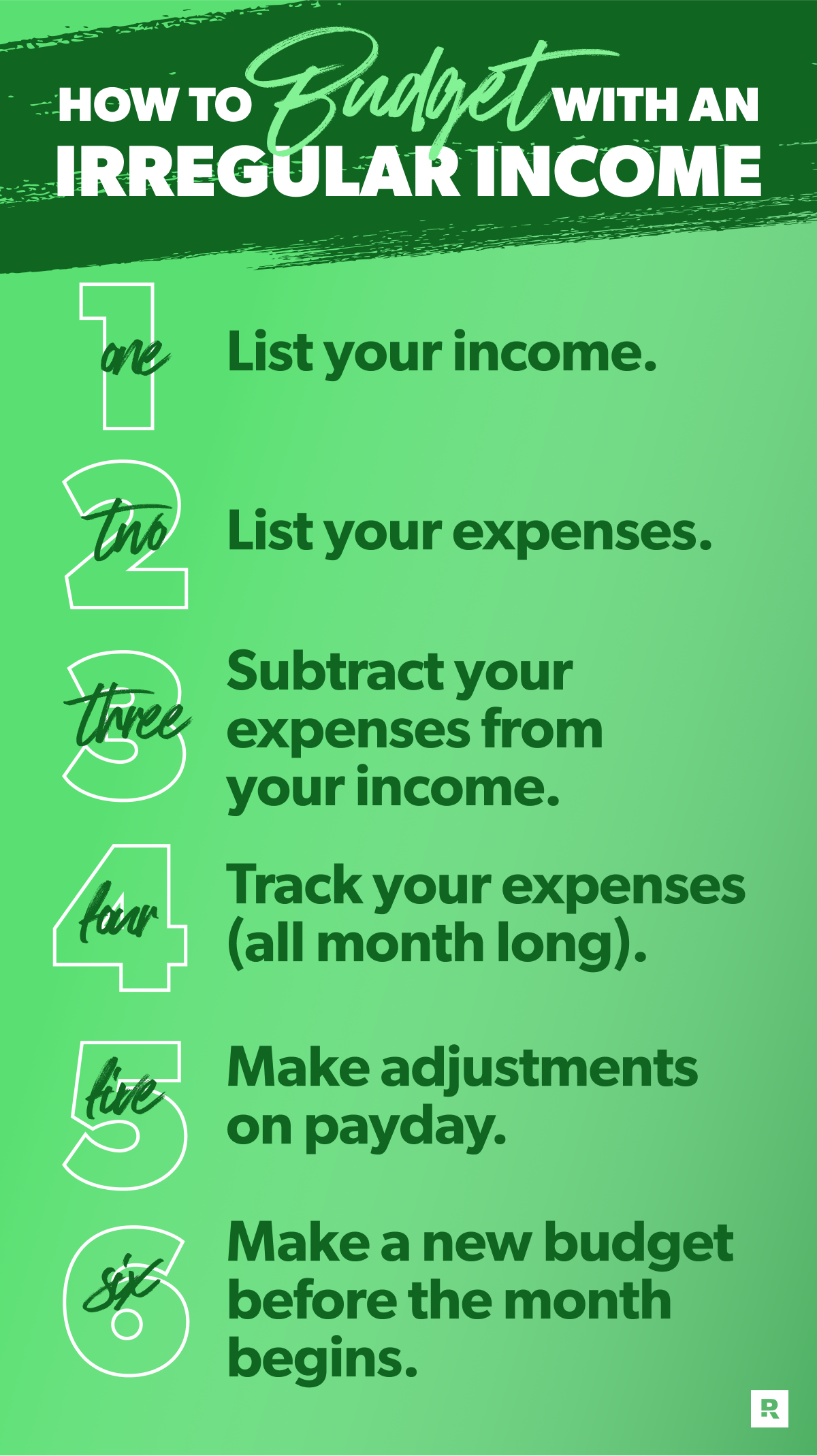

But yous can—and should—budget every month, irregular income or not. It takes a little getting used to, but it isn't hard if y'all follow these six steps.

1. List your income.

If you've got an irregular income, plan depression. That'due south right—you should prepare your budget based on your everyman monthly income guess.

It'south mode better to start low than to start with an average. Why? Considering if you budget low, y'all tin can always go up from at that place. But guessing loftier and having to back off later—that's spells trouble. (Non literally, of course.)

To notice your starting point, look back at some past pay stubs. What'southward the lowest you've fabricated in the concluding few months? Go with that.

If this is your first time working on committee or living on an irregular income, don't worry! For now, approximate what your lowest month volition look like. And put that in as your income.

Start budgeting with EveryDollar today!

By the style, if yous want to start off using pencil and newspaper, check out our Irregular Income Budget Planning form! It can actually aid to write out and see those numbers in black and white (or whatever color ink you use).

Simply and then, we think you should upgrade your experience by downloading EveryDollar, our gratis budgeting app. Considering listen, making—and keeping—a monthly budget is mode easier with EveryDollar. But saying.

2. List your expenses.

Okay, in one case you've planned for all the money coming in, it'southward time to prep for all the money going out. That's right, it's time to list your expenses.

Now, before you dive into the bills and everything else, set aside coin for giving. We believe in giving 10% of your income to your church or a charity. And if you don't have an emergency fund withal, brand savings your next priority.

Afterward that, focus on covering what we call the Four Walls: food, utilities, shelter and transportation. Then, budget for all your other monthly expenses. Start with the essentials, like insurance, debt and childcare.

Finally, give yourself a miscellaneous line and budget for nonessentials, similar Idiot box streaming services, restaurants, adult kickball league fees, subscription boxes and personal spending.

But remember—if you have an irregular income, y'all may non be able to enjoy certain extras every calendar month.

For example, if you have a month of lower income, that might mean you have to cut spending in places similar your entertainment category. Maybe this month, you lot're renting a motion picture and getting frozen pizzas to eat at habitation instead of going out for dinner and a movie. (Which actually sounds really nice anyhow.)

Hey, you take to cover your needs before your wants. Period. But you've got this.

Let'southward recap the heavy hitter here: Y'all might have to skip some of the extras (or plan low) at beginning. But if your income ends up higher than what you've planned—well, Step 5 covers that! Only don't skip alee. Read it all!

three. Subtract your income from your expenses.

This number should equal zilch, which is why nosotros call it zilch-based budgeting.

Okay, make certain you understand that the zero here doesn't mean you let your bank account accomplish nil. Ever. Leave a piddling buffer in there of about $100 to $300.

And so, why zip? A zero-based budget is our absolute favorite budgeting method because it's all well-nigh giving every dollar a job—whether that'southward giving, saving, paying off debt, or spending. Every dollar that comes in has a purpose that you assign it! Because dollars without jobs get spent accidentally on impulse buys and mindless, daily java runs.

Remember, spending isn't bad. Just spending without purpose will keep your financial goals miles out of attain. Forever.

Let's talk some logistics here, though. What if you subtract your expenses from your income and yous've got coin left over? Um, give yourself some high fives. (Is that just clapping?) And so put those dollars to work by putting whatever "actress" coin toward your electric current money goal.

What if you end up with a negative number? This is really pretty probable if y'all've got an irregular income. You're budgeting low, remember? Merely information technology's okay if your numbers are off. You only demand to cut the extras (at least for now) until your income minus your expenses equals nada.

4. Track your expenses (all month long).

Want to know what i of the biggest secrets to budgeting well is? We won't concord dorsum. Not fifty-fifty for a 2nd. Hither it is: Track. Your. Expenses.

What does that hateful? When you spend money on something, you lot subtract that corporeality from its budget line. That fashion you ever know how much money you have left to spend. And that keeps you from overspending.

When y'all make money, add that to your planned income for the calendar month. This is incredibly important if you have an irregular income, considering tracking your income volition show you if you made as much every bit yous planned or not.

And hopefully, you lot made more than y'all planned. Who doesn't dearest information technology when that happens? We'll talk in the next step nearly what to do when you take extra money to budget, but starting time nosotros want to make sure we've covered all the bases about why you lot have to track expenses.

Budgeting is planning where your money will go. Tracking expenses shows you where the coin did become. Tracking expenses holds you accountable—to yourself!

And so runway those expenses. Every single 1.

v. Make adjustments on payday.

The key to winning with budgeting on an irregular income is beingness flexible and staying on meridian of information technology. Ane of the ways you exercise that is by adjusting your budget as you get paid.

If your income ends up being college than you planned, make sure you give yourself those awkward high fives nosotros mentioned earlier. So, add the extra income to your upkeep.

And so, if you set your monthly income to $four,500 only actually made $5,000, go back and add together that extra $500 in as income.

And then what?

Well, you lot nonetheless want a zero-based upkeep. And you had one, until that lovely extra $500 came in. (Nice problem to have, right?)

Time to put that money to work! You can add it to your current Baby Footstep (aka the proven plan to saving, paying off debt, and edifice wealth).

Also, you might get back to one of those extras you lot cutting back on or skipped when you beginning made your budget and requite it some financial love.

half dozen. Brand a new upkeep (before the month begins).

Yay! You lot fabricated a budget, and now you never have to make another one over again, right?

Well, no. A budget isn't a slow cooker. You don't set it once and forget it. You've got to arrive there and rail those expenses. You've got to make adjustments forth the style.

And you've got to brand a new budget every single calendar month! It'due south more like a fantastic progressive dinner or five-course repast. Information technology takes time and endeavor merely is super worth information technology.

Your budget doesn't change that much month to month—but information technology's not e'er 100% the aforementioned. And so, copy over this month's budget for the next, and then tweak every bit you lot need to. That means adding in calendar month-specific expenses, like your BFF's birthday or that oil alter you need.

And e'er make your budget before the calendar month begins so you're ahead of your money, non lagging behind.

You Can Upkeep (and Do Information technology Well!) With an Irregular Income

Think, anything worth winning takes piece of work. And so, if you want to win with money—yous'll have to work at it. It usually takes around three months to get comfy with budgeting, no matter your income. And then, continue going. You actually tin can do this.

But nosotros'll be honest: It'due south way easier to budget well when you've got a budgeting tool. And it's way, manner easier when that tool is mobile and was created specifically to help you take on those Baby Steps.

That's EveryDollar. Download information technology today and so y'all can start budgeting meliorate and crushing your coin goals even quicker.

Start your free EveryDollar upkeep. Right. At present.

About the writer

Ramsey Solutions

Source: https://www.ramseysolutions.com/budgeting/how-to-budget-an-irregular-income

Posted by: whitmoresley1942.blogspot.com

0 Response to "How To Save Money Budgetting Based On Last Months Income"

Post a Comment